June 26, 2023

Millions of Insured Older Americans Face Unpaid Medical Bills

Medical debt for older Americans with health insurance is on the rise: new research published by the Consumer Financial Protection Bureau Office for Older Americans found that while 98% of people over the age of 65 have health insurance through enrollment in programs like Medicare, many are still swamped with unpaid bills for medical care.

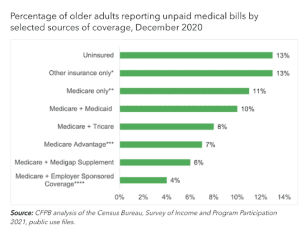

Nearly four million older adults could not pay their medical bills in full in 2020, the latest year that data is available, per the report. Over two-thirds of those with unpaid bills had coverage from more than one source, such as Medicare, Medicare Advantage, Medicaid, Medigap, employer-based coverage, or Tricare, the overall military health plan.

The average amount in unpaid medical bills reported by older adults in that period was $13,800, up 20% from $11,700 in 2019. That translates to an increase in unpaid medical bills among older adults from $44.8 billion in 2019 to $53.8 billion in 2020.

The most common causes are out-of-network charges, deductibles and other cost-sharing fees, services that are not covered by Medicare, in addition to frequent and complex medical care, and limited income, according to the researchers. However, the biggest reason for falling behind is medical billing errors.

The most common causes are out-of-network charges, deductibles and other cost-sharing fees, services that are not covered by Medicare, in addition to frequent and complex medical care, and limited income, according to the researchers. However, the biggest reason for falling behind is medical billing errors.

“Older adults are more likely to have complicated health needs, which require a great deal of documentation,” said Richard Fiesta, Executive Director of the Alliance. “This can lead to delays in payment, errors in who is billed, and providers seeking inappropriate reimbursement. Whenever possible, patient advocates advise working with your health care providers to make sure a procedure is covered before you receive the care.”