Fact Sheets and Position Papers

Project 2025 Fact Sheet

In April 2023 the Heritage Foundation, a conservative think tank in Washington, D.C., published “Mandate for Leadership, the Conservative Promise, Project 2025.”

In April 2023 the Heritage Foundation, a conservative think tank in Washington, D.C., published “Mandate for Leadership, the Conservative Promise, Project 2025.”

The 900-page policy blueprint provides a policy roadmap for a second Trump Administration, should he be elected in November. It was developed by a number of former Trump administration officials, and it reflects input from over 100 conservative organizations.

Project 2025 would dramatically reshape the federal government by placing the entire Executive Branch of the U.S. government under direct presidential control, eliminating the independence of the Department of Justice, the Federal Bureau of Investigations, the Federal Communications Commission and all other federal agencies, as well as potentially firing thousands of federal government employees.

Of particular concern to older Americans, Project 2025 would make dramatic cuts and changes to Medicare, increase the price of prescription drugs, and allow states to eliminate or reduce Medicaid coverage for nursing home care.

Inflation Reduction Act Fact Sheet

One in four people over the age of 65 report not taking at least one prescription drug as prescribed due to its cost. Meanwhile, pharmaceutical corporations are making record profits, lining the pockets of their executives and shareholders while patients struggle to afford the drugs they need to stay healthy.

One in four people over the age of 65 report not taking at least one prescription drug as prescribed due to its cost. Meanwhile, pharmaceutical corporations are making record profits, lining the pockets of their executives and shareholders while patients struggle to afford the drugs they need to stay healthy.

To help reverse the pharmaceutical industry’s stranglehold on our health care system, on August 16, 2022 President Biden signed the Inflation Reduction Act into law. It means lower prescription drug prices for millions of Medicare beneficiaries.

Debt Commission Legislation Fast Tracks Cuts to Social Security and Medicare

Social Security and Medicare have been the foundation of retirement security for generations of Americans, providing income and health care to millions. Americans earn these benefits, contributing to them with every paycheck.

Social Security and Medicare have been the foundation of retirement security for generations of Americans, providing income and health care to millions. Americans earn these benefits, contributing to them with every paycheck.

On January 18, 2024 the House Budget Committee passed H.R. 5779, the Fiscal Commission Act, introduced by Rep. Bill Huizenga (R-MI), on a 22-12 vote and House Republican leaders say they are looking to get it to the House floor quickly.

Sens. Joe Manchin (D-WV) and Mitt Romney (R-UT) have also introduced companion legislation in the Senate, S. 3262, the Fiscal Stability Act.

Social Security and Medicare Facts and Figures

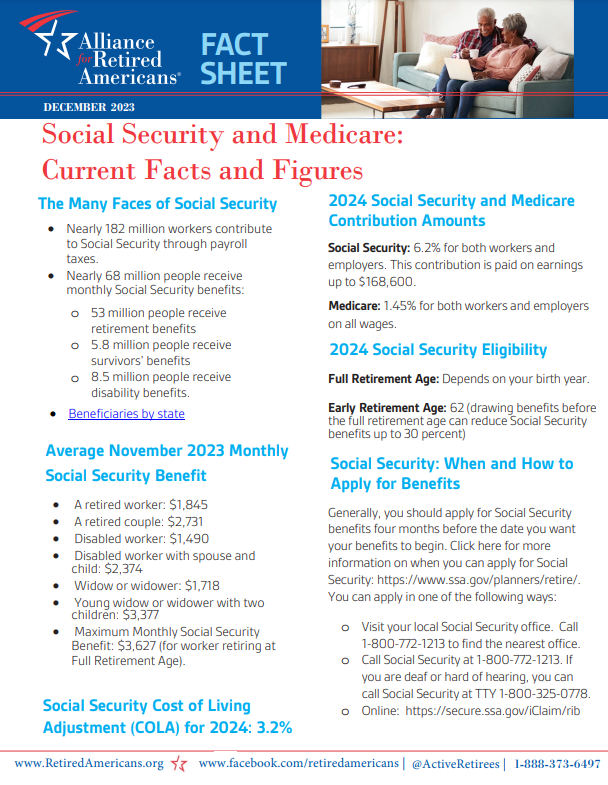

Nearly 182 million workers contribute to Social Security and Medicare through payroll taxes. Details like benefit amounts and premiums change each year.

Nearly 182 million workers contribute to Social Security and Medicare through payroll taxes. Details like benefit amounts and premiums change each year.

Our fact sheet has the latest figures.

Expanding Social Security Position Paper

Today 66 million Americans – one out of every five households – relies on Social Security’s lifetime, guaranteed benefits.

Today 66 million Americans – one out of every five households – relies on Social Security’s lifetime, guaranteed benefits.

To continue to provide retirement security for current and future generations, it is time to strengthen and expand Social Security and increase benefits. Many members of Congress recognize the need for action and are proposing legislation that will ensure the Social Security system remains strong and Americans receive the benefits they have earned.

RSC Budget Proposal Position Paper

The Republican Study Committee (RSC), a House Caucus consisting of175 members out of a total Republican House Caucus of 217 members (80%), including every member of House Republican leadership, proposed a budget that calls for cuts to future Social Security retirement benefits and

The Republican Study Committee (RSC), a House Caucus consisting of175 members out of a total Republican House Caucus of 217 members (80%), including every member of House Republican leadership, proposed a budget that calls for cuts to future Social Security retirement benefits and

spending reductions in Social Security and Medicare. In addition to the proposed 31% cuts to non-defense discretionary spending, the RSC budget would force devastating cuts to numerous social services and programs that older Americans rely on.

The Alliance strongly rejects this approach and believes that any changes to Social Security and Medicare must start from the premise that the benefits the American people have earned and deserve are a sacred promise between workers and the government. They must be kept intact, strengthened, and expanded for future generations by ensuring all Americans pay their fair share.

Threats to Social Security

For decades Social Security has delivered guaranteed, lifetime benefits on time and without interruption to generations of Americans. Beneficiaries earn their Social Security, contributing into the system with every paycheck.

For decades Social Security has delivered guaranteed, lifetime benefits on time and without interruption to generations of Americans. Beneficiaries earn their Social Security, contributing into the system with every paycheck.

Sixty-five million older Americans, people with disabilities and family members of deceased workers – one out of every five households – relies on Social Security.

In the 118th Congress a growing number of legislators are promoting ideas that put these earned benefits at risk.

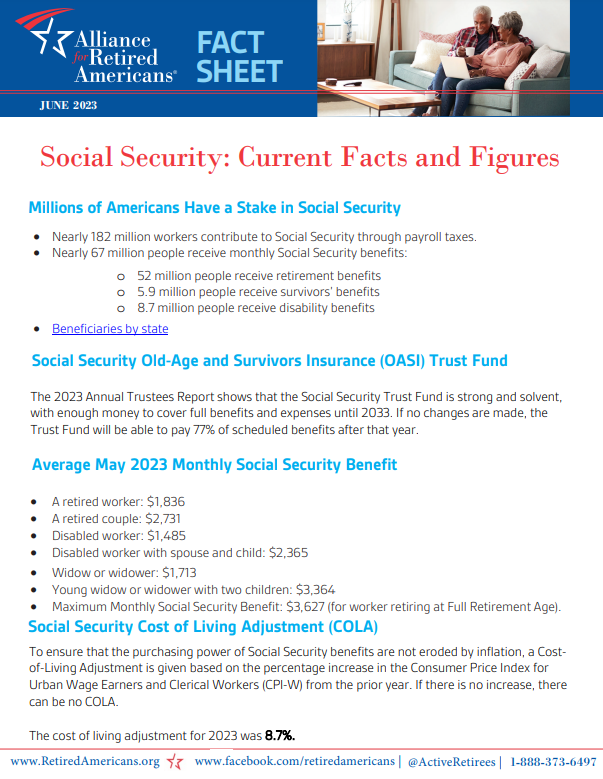

Social Security Current Facts and Figures

Nearly 182 million workers contribute to Social Security through payroll taxes. Details like benefit amounts and premiums change each year.

Nearly 182 million workers contribute to Social Security through payroll taxes. Details like benefit amounts and premiums change each year.

Our fact sheet has the latest figures for 2023.

Medicaid Fact Sheet

Medicaid is a social safety net program that provides health coverage for pregnant women, children, the disabled and seniors with low-incomes.

Medicaid is a social safety net program that provides health coverage for pregnant women, children, the disabled and seniors with low-incomes.

PRO Act Position Paper

The labor movement has been, and continues to be, the leading force in the fight to strengthen Social Security, Medicare and Medicaid, ensuring a measure of retirement security for all Americans. Our country, our democracy and our people benefit when workers have a strong voice at work and are able to join together to build a more secure future for their families and their communities.

The labor movement has been, and continues to be, the leading force in the fight to strengthen Social Security, Medicare and Medicaid, ensuring a measure of retirement security for all Americans. Our country, our democracy and our people benefit when workers have a strong voice at work and are able to join together to build a more secure future for their families and their communities.

To strengthen workers’ voices on the job, Representative Bobby Scott (D-VA) and Brian Fitzpatrick (R-PA) introduced the Richard L. Trumka Protecting the Right to Organize (PRO) Act, H.R. 20, in the U.S. House of Representatives. Senator Bernie Sanders (I-VT) introduced it in the U.S. Senate.

Social Security Fairness Act

The Government Pension Offset (GPO) and Windfall Elimination Provision (WEP) were enacted in 1977 and 1983 respectively as amendments to the basic Social Security law. These provisions reduce Social Security benefits for public sector retirees who receive a public pension or the spouse or survivor of a Social Security beneficiary who worked for a period of time in a job not covered by the Social Security program.

The Government Pension Offset (GPO) and Windfall Elimination Provision (WEP) were enacted in 1977 and 1983 respectively as amendments to the basic Social Security law. These provisions reduce Social Security benefits for public sector retirees who receive a public pension or the spouse or survivor of a Social Security beneficiary who worked for a period of time in a job not covered by the Social Security program.

In January 2023, Representatives Garret Graves (LA) and Abigail Spanberger (VA) introduced the Social Security Fairness Act (H.R. 82). Companion legislation has also been introduced in the Senate (S 597) by Senators Sherrod Brown (D-OH) and Susan Collins (R-ME). The bill would repeal the WEP and GPO provisions and allow those affected to keep the full Social Security benefits they or their spouses earned.