June 03, 2021

Caring for an Aging Nation

A Variety of Services Booming Number of Seniors The Cost of Long-Term Care Services The Physical – and Financial – Burden The $61 Billion Price Tag

Health care for the nation’s seniors looms large as the baby-boom generation ages into retirement. President Joe Biden tacitly acknowledged those needs in March with his proposal to spend $400 billion over the next eight years to improve access to in-home and community-based care.

The swelling population of seniors will far outpace growth in other age groups. That acceleration — and the slower growth in other age groups — could leave many older Americans with less family to rely on for help in their later years. Meanwhile, federal officials estimate that more than half of people turning 65 will need long-term care services at some point. That care is expensive and can be hard to find.

Spending for paid long-term care already runs about $409 billion a year. Yet that staggering number doesn’t begin to reflect the real cost. Experts estimate that 1 in 6 Americans provide billions of dollars’ worth of unpaid care to a relative or friend age 50 or older in their home.

As the country weighs Biden’s plan, here’s a quick look at how long-term care works currently and what might lie ahead.

A Variety of Services

More than 65,000 paid, regulated service providers cared for 8 million Americans in 2016, according to the most recent federal report. In addition, AARP estimates more than 50 million people provide unpaid care, generally to family members.

Home Health Care

Care that occurs in the home, usually done by an unpaid caregiver or by a health aide, who may be employed by an agency (does not include hospice services).

12,200 home health care agencies

Community Support Services

Supplemental care including services such as adult day care centers and transportation.

4,600 adult day care centers

286,300 adults enrolled in adult day care service centers

Assisted Living/Retirement Communities

Residential facilities that can offer a variety of care levels, including assisted living centers and memory care.

28,900 assisted living and other residential care communities

811,500 residents

Nursing Homes

Full-time residential facilities that offer 24-hour supervision and nursing care.

15,600 nursing homes

1.35 million residents

Note: Data from 2016

Source: National Center for Health Statistics

Note: Data from 2016Source: National Center for Health Statistics

Booming Number of Seniors

As baby boomers age, 10,000 people a day pass their 65th birthday. The Census Bureau estimates that more than 94.6 million people will be 65 or older in 2060.

From January to June 2018, the percentage of older adults age 85 and over needing help with personal care was more than twice the percentage for adults ages 75-84 and five times the percentage for adults ages 65-74.

4% of 65-74

Source: Administration for Community Living’s 2019 Profile of Older Americans

8% of 75-84

21% of 85+

The Cost of Long-Term Care Services

From 2004 to 2020, the cost for facility and in-home care services has risen, on average, between 1.88% and 3.8% each year.

The median income for a household in which the head of the household is 65 or older was $47,357 in 2019.

Sources: Genworth; U.S. Census Bureau

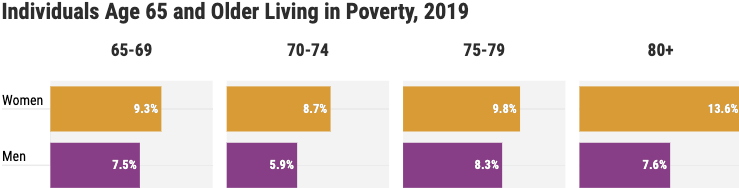

The Physical – And Financial – Burden

Source: HHS Office of the Assistant Secretary for Planning and Evaluation

Source: HHS Office of the Assistant Secretary for Planning and Evaluation

Source: U.S. Government Accountability Office

Source: Congressional Research Service

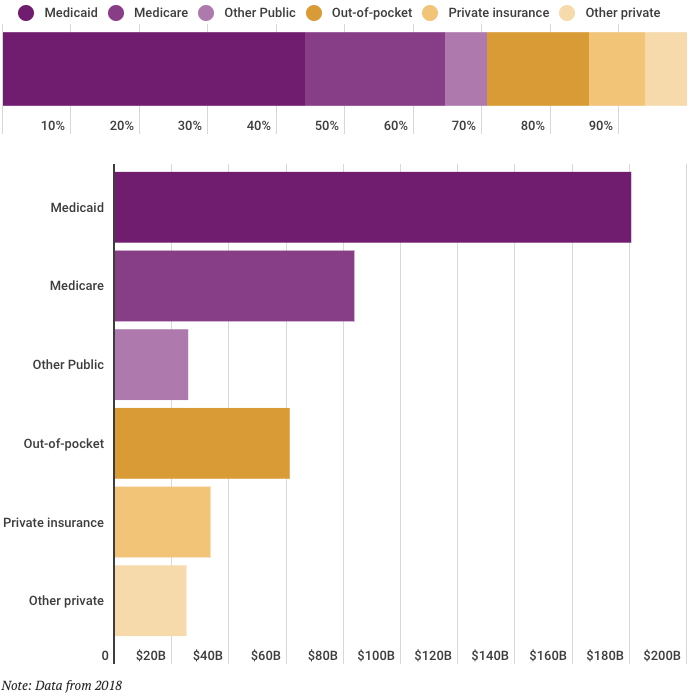

The $61 Billion Price Tag

Medicaid pays for the majority of long-term care services, but Americans also pay $61 billion out-of-pocket.

Source: Congressional Research Service

Medicaid

The federal-state health care insurance program for low-income and disabled Americans is the single-largest payer of long-term and community-based care and some in-home services. To qualify, many families must “spend down,” or reduce the older adult’s income and assets. And waiting lists for in-home care services in many states are long.

Medicare

The federal health insurance program for seniors and certain people with disabilities usually pays for acute care and post-acute, skilled nursing care and home health care services.

Other Public Programs

Other public spending comes from different sources, including states, localities, the Veterans Health Administration and the Children’s Health Insurance Program. Over half of this spending covered long-term care services given at residential care facilities for people with various mental health conditions and developmental disabilities.

Out-of-Pocket

These costs, paid for by individuals, include deductibles and copays for services as well as the direct payments made toward covering long-term care.

Private Insurance

Private health care plans usually cover payments for some limited home health and skilled nursing related to rehabilitation. Long-term care insurance may also help with these costs.

Other Private Funding

These funds generally come from nonprofit philanthropic groups, private individuals or corporations.

KHN’s coverage related to aging and improving care of older adults is supported in part by The John A. Hartford Foundation.

This story was produced by KHN, which publishes California Healthline, an editorially independent service of the California Health Care Foundation.